Impact of Infrastructure Development on Property Prices

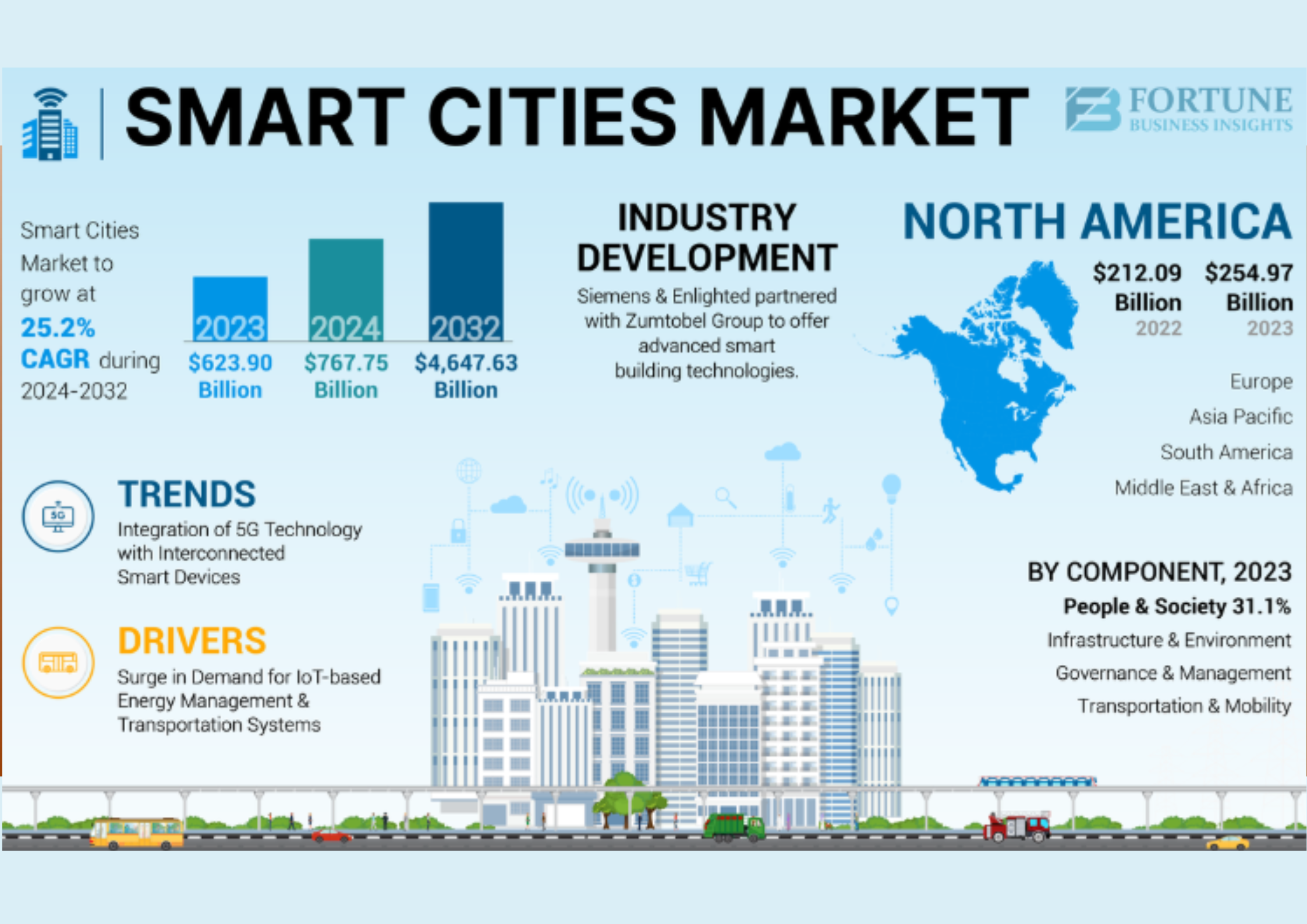

Infrastructure development plays a major role in shaping real estate markets. Projects like roads, highways, metro rail, airports, and smart city initiatives directly affect property prices and demand.

Improved Connectivity Increases Value

When new roads, flyovers, or metro lines are developed, travel becomes faster and easier. Areas with better connectivity attract more buyers, leading to a rise in property prices.Growth of New Residential & Commercial Hubs

Infrastructure projects often create new business and residential zones. Offices, malls, schools, and hospitals come up around these areas, increasing demand for nearby properties.

Higher Demand from Investors

Investors prefer locations with strong infrastructure because they promise better returns. As demand rises, both property prices and rental income increase.

Better Quality of Life

Good infrastructure improves daily living. Reliable transport, utilities, and public services make areas more desirable, pushing property values higher.

Urban Expansion & Development

Infrastructure encourages development in suburban and developing areas. Locations that were once less popular gain attention, resulting in steady price appreciation.

Increased Employment Opportunities

Large infrastructure projects create jobs and attract businesses. More employment means more housing demand, which positively impacts property prices.

Long-Term Price Appreciation

Properties near major infrastructure projects usually show long-term growth. Even before project completion, prices often rise due to future expectations.

Conclusion

Infrastructure development is a strong driver of real estate growth. Areas with modern infrastructure offer higher property values, better rental returns, and long-term investment potential.