How to Identify High-Growth Areas for Property Investment

Investing in property is a smart way to build long-term wealth. But the real success depends on choosing the right location. High-growth areas give better returns through price appreciation and rental income. Below are some easy ways to identify such areas

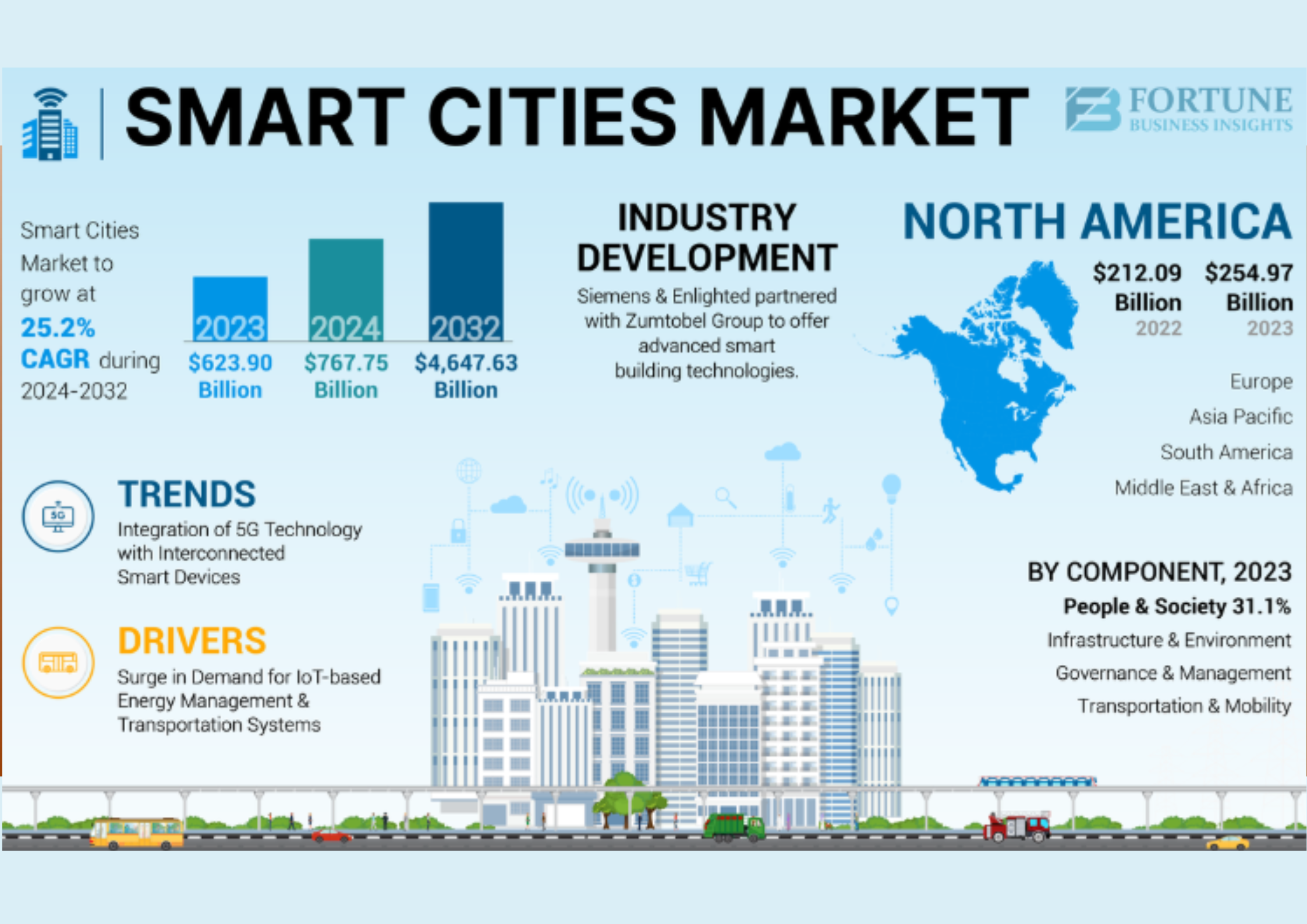

1. Check Infrastructure Development

Rental income means regular monthly income earned by renting out a property.

Areas with upcoming infrastructure projects usually grow faster. Look for:

- New highways and flyovers

- Metro or railway projects

- Airports and smart city plans

Good infrastructure improves connectivity, which increases property demand.

2. Observe Job and Business Growth

Locations near IT parks, industrial hubs, business centers, and SEZs attract working professionals. More jobs mean more people moving in, which raises housing demand and property value.

3. Study Past Price Trends

Check how property prices have changed in the last 3–5 years.

- Consistent price increase = positive growth sign

- Sudden price jump without development = risky area

Past trends help you understand future potential.

4. Look at Population Growth

High-growth areas usually see an increasing population. Migration for jobs, education, or lifestyle indicates rising demand for housing, rentals, and commercial spaces.

5. Analyze Rental Demand

Areas with strong rental demand offer steady income. Look for:

- Nearby colleges and offices

- Hospitals and commercial zones

- Public transport availability

- High rental demand shows that people want to live there.

6. Check Government Plans and Policies

Government-supported development boosts growth. Watch for:

- Smart City projects

- Affordable housing schemes

- Industrial corridor announcements

Official plans often lead to long-term appreciation.

7. Compare Property Prices with Nearby Areas

If one area is cheaper than nearby developed locations but has similar future plans, it may be a high-growth opportunity.

8. Consult Local Experts

Local real estate agents, builders, and residents provide valuable ground-level information about future development and demand.

9. Evaluate Social Infrastructure

High-growth areas have good:

- Schools and colleges

- Hospitals and clinics

- Shopping centers and parks

These facilities improve lifestyle and increase property value.

10. Check Legal and Title Clarity

Even a fast-growing area is risky if legal documents are unclear. Always verify approvals, land titles, and zoning regulations before investing.

Final Thoughts

Identifying high-growth property areas requires research, patience, and smart analysis. Focus on infrastructure, job growth, rental demand, and government plans. A well-chosen location can give strong returns and long-term security.