Current Real Estate Market Trends in India

1. Residential Real Estate: Prices & Demand

- Home prices increased in major cities like NCR, Bengaluru, Hyderabad and Mumbai, mainly because more buyers are choosing premium and better-located homes.

- Although total deals (units sold) may be lower in some big cities, the value of the market is still growing because people are buying larger or more expensive homes.

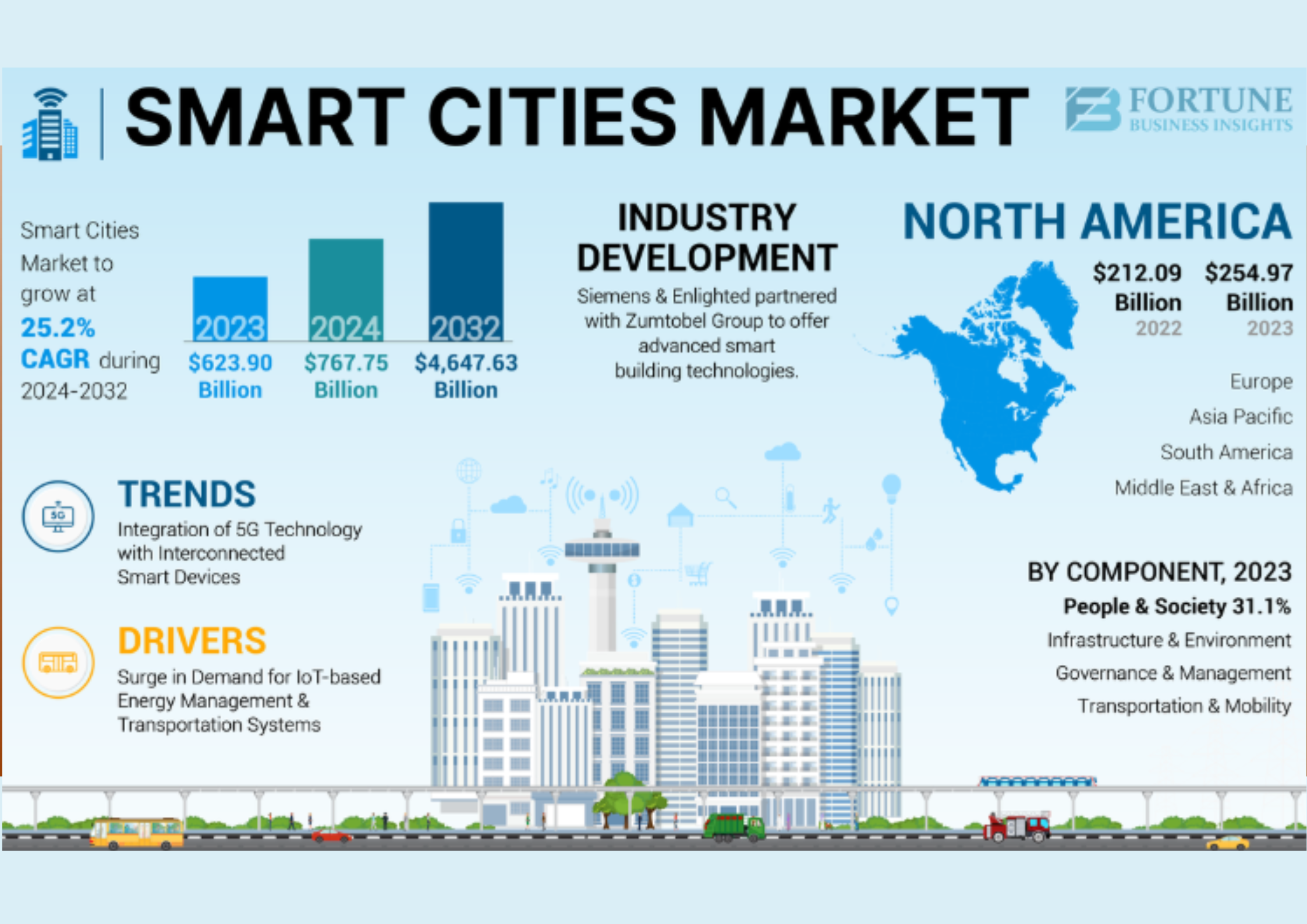

- Airports and smart city plans

Both affordable/mid-income housing and premium segments are active — affordable units still attract first-time buyers, while luxury homes attract wealthy buyers and investors.

2. Shift Toward Integrated & Experience-Led Homes

- Buyers today want more than just a house — integrated townships with shopping, entertainment, parks, and amenities are trending.

- Developers are focusing on experience-led and sustainable living spaces, including green homes with wellness, eco-friendly features, and community

Past trends help you understand future potential.

3. Commercial Real Estate & Office Spaces

- Demand for modern office spaces continues, especially high-quality space in cities like Delhi-NCR and Mumbai, even though new completions have slowed.

- There's also strong interest in flexible office models and co-working spaces, reflecting hybrid work trends.

4. Growth in Tier-2 & Tier-3 Cities

- Smaller cities (like Lucknow, Indore, Jaipur, Kochi, Coimbatore etc.) are becoming new growth hubs due to improving infrastructure and better job opportunities.

- These cities often offer more affordable pricing and higher potential for price appreciation compared to very expensive Tier-1 markets.

5. Technology & Sustainability Trends

- PropTech (property technology) is growing quickly — virtual tours, AI-based recommendations, paper-free processes, and online approvals are making buying easier.

- Sustainability is no longer optional — green buildings, energy-efficient designs, and ESG compliance are now important for both buyers and investors.

6. Investment & Foreign Money

- Big investments from both domestic and foreign investors continue, especially in commercial property, retail space, and land development.

- Institutional investors and private equity are also fueling growth in non-residential segments.

7. Market Challenges

- Some areas are seeing a slowdown in unit sales, especially in high-priced metro markets, because rising prices have made homes less affordable. Many buyers find it harder to buy due to high costs and financing concerns, especially in Tier-1 cities.